New Era of Gold's Global Domination

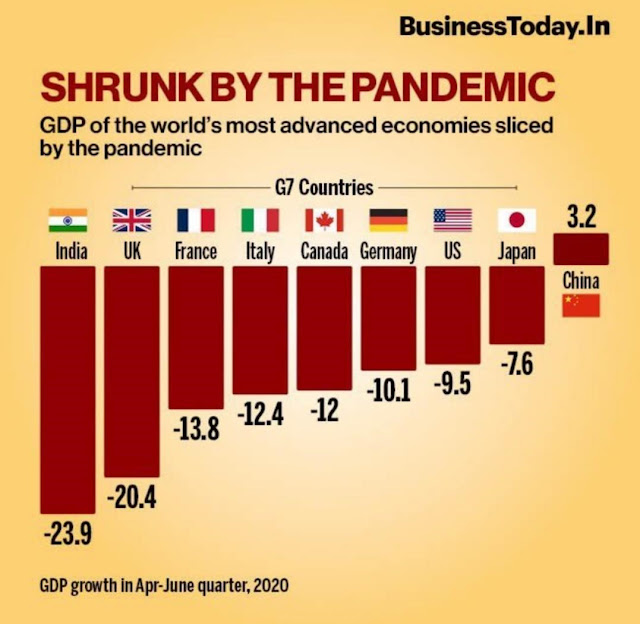

Apart from the stark difference between India's and China's real yield, this graph is also foretelling us the story of the time that is about to come.

If you are an FD/G-Sec investor, the policy rate is the metric you should currently have a look at. The current policy rate in India is 4.00% (Repo Rate). State Bank of India's (SBI) one-year fixed deposit is offering 5.10%.

The yields mentioned above are Nominal yields and are without incorporating the effect of inflation. The Retail Inflation (CPI) for June was 6.09% (From 5.84% in March). Though it was mainly driven by the spike in food prices as clearly evident from the steep rise in the Consumer Food Price Index (CFPI) (9.62% July (E), 8.72% June)

The RBI’s medium-term inflation target range is 2-6%. It is expected to remain near the upper range for some time. The repo rate is also likely to stay in the 3.5-4.5% range.

Investing in a Fixed deposit no longer makes any sense in India. If your investment horizon is longer than a couple of years, then you should go for the NIFTY's ETF or the global favourite at the moment...GOLD (ETF's, Digital Gold).

Gold will not only protect you from inflation but it will also hedge your portfolio from country and currency risk. If you have any doubt about this statement just have a look at another Emerging country Turkey's currency Lira. Governments have botched up in the past and they will do the same in the future.

Don't put all your eggs in one single basket. GOLD is the only real and stable money you could potentially have at this point in human history. A new era of Gold's domination has just begun.

Comments

Post a Comment